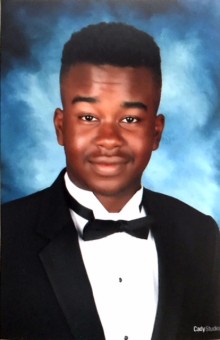

Name: Jordan George Mccord

From: Sandy Springs, GA

Votes: 0

Four years ago I attended Wealthy Habits, a non for profit program for

kids and teens that help teach them how to manage money wisely. The

things I learned during the course were invaluable, and made me want

to participate in the program in a leadership role. I wanted to

impact other kid’s lives by teaching them about financial literacy.

I’ve seen how the lack of financial education can lead to poor

spending habits, large amounts of consumer debt, bankruptcy and even

poverty.

I believe the wealth gap is the most pressing issue in the United

States today. It affects the ability for people to provide for

themselves and their families. According to CNBC.com, the top 1% owns

half of the world’s wealth. In the United States, the top 10% of

families hold over 75% of the nation’s wealth and, in contrast, most

Americans have almost no savings and live paycheck to paycheck. The

wealthy have access to capital, often from inheritance, and financial

education that gives them a huge competitive advantage. One way to

start to close the wealth gap is through financial literacy.

After I expressed interest in pursuing a leadership role at Wealthy Habits,

the Executive Director, Tracy Tanner

revealed to me that they were considering starting a student

instructor program. That summer, I worked almost every week, and

assisted in running the daily activities and lessons. I would teach

the kids how to: plan and invest, pay taxes, write checks, etc. I was

able to see the kids transform from being shy and naive, to erudite

and confident. I felt what I was doing was really making a

difference. While helping teach the high school class about how to

fill out a budget. One girl asked me what a budget was and I was

shocked. I couldn’t believe that she had gotten to high school

without learning about budgets. But then I realized that my school

didn’t cover this material either. We learn about economics but

not how manage our personal finances. Without programs like Wealthy

Habits, people would have almost no access education on how to be

financially successful.

Understanding this, I tried to help every kid that came through the program gain as

much information as possible. I felt it was important to teach them

so well, that they could spread the knowledge to others. In addition

to being a teacher, I prided myself on being a role model for other

kids. They looked up to me because I was much closer to their age

than the traditional instructor. I used my influence, to help get key

points across. I remember, one day, a boy named Micah seemed

uninterested in the subject we were covering, the importance of

having a savings account. I noticed this and went to talk with him. I

told him about how I had begun saving my money earlier in the year,

and had already accumulated almost $1000. I then let him know that

since he was about four years younger than me, if he started saving

now he could have way more than that. His face lit up and from then

on he began asking tons of questions and was really eager to learn.

Another way to help to close the wealth gap is entrepreneurship.

Entrepreneurship, done strategically, can set up families and

communities up for generational success. However, it is more

difficult for many minority groups and poorer Americans to create

multi-generational wealth. They often start business that create

fewer jobs and generate less income. These businesses often do not

survive the owner’s death. We must find ways to provide better

financial education and greater access to capital if we want to

reverse this trend.

In the fall I will attend Babson College because it is ranked #1 for

Entrepreneurship and has the best reputation for providing the

education and training I need to start a business that can scale and

have a great impact on all communities. My vision is to create

a business that employs lots of people in high paying jobs, that

has a positive long term impact on society.

Through my time at Wealthy Habits, I’ve learned the impact teaching others

can have, especially on younger generations. I’ve seen kids learn so

much that they want to pass on the information. My intention is to

either start a club on campus that promotes financial literacy or

join an existing club, like the Babson Leadership Club, and integrate

my knowledge of financial literacy into the program.